Overview The Brazilian real estate sector experienced significant growth in 2007. Contributing to this scenario was a number of different measures, including an increase in the supply of credit and longer loan contracts, stimulated by government’s inflation targeting policy and reduction in interest rates.

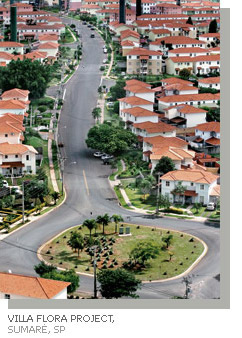

Macroeconomic Outlook The demand for residential real estate in Brazil will continue increasing over the upcoming decades, mainly in the economy housing segment market. Among the factors that justify this statement are more accessible lines of financing and economic stability, which should continue during the next few years. As a result, a major portion of the population will increasingly be in a position to take on long-term debt to purchase real estate. The population growth, the large number of young people as a percentage of the total population, the reduction in the number of inhabitants per household, the increasing number of women in the workforce and the socio-cultural preference for home ownership are other factors that are expected to influence the fulfillment of this scenario. Real state credit According to data from the Brazilian Association of Real Estate Savings and Credit Enterprises (Abecip) and the Brazilian Central Bank, the amount of real estate credit in the Brazilian financial system increased 55% in 2007, rising to R$ 25.3 billion by the close of the year. With regard to the financing of homes through savings funds, in 2007 Abecip registered R$ 18.302 billion for 195,981 units. These numbers are 96% and 72% higher than those from the previous year. The information summarized above confirms the resumption of real estate credit, which began in 2003. The conditions for this process came about as a result of the decline in interest rates, economic stability and recovery of workers’ purchasing power. Through the Real Estate Financial System Law (SFI), of 1997, financial institutions began to adopt the fiduciary transfer regimen as the guarantee for the loans that were granted. As a result, there was significant improvement in risk evaluation for mortgages, providing longer maturities and an increase in the percentage financed.

Competitive Environment The factors that, taken together, contributed to the current boom in the sector were:

Because the Brazilian housing deficit is strongly concentrated in the lower classes, this segment is certainly the one with the highest growth potential, and this has led many companies that previously were active in the high-end segment to return to developing for the lower class segments. |

|||