CAPITAL MARKETS

CORPORATE STRUCTURE

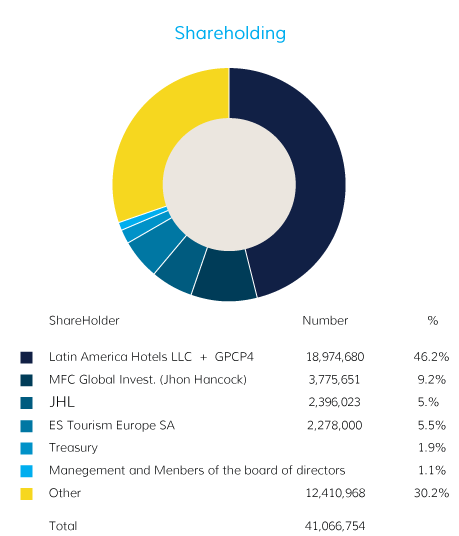

BHG is directly controlled by Latin America Hotels, LLC, which holds approximately 46.0% of its total and voting capital stock. Latin America Hotels, LLC is, in turn, an indirect subsidiary of the investment fund GP Capital Partners IV L.P. (“GPCPIV” or “Fund”), duly incorporated under the laws of the Cayman Islands, which holds approximately 89.47% of the voting and total capital of Latin America Hotels LLC and, as a result, indirectly, approximately 40.4% of BHG's capital stock. GP Investments Ltd., through GP Private Equity, Ltd., as a limited partner of GPCPIV, has, indirectly, approximately 14% of BHG's capital stock. GPCP4 also holds approximately 1% of a direct interest in BHG.

SHARE PERFORMANCE

| Annual Data | 2011 vs. 2010 |

2010 vs. 2009 |

||||

| Capital Market | 2011 | 2010 | 2009 | Δ% | Δ% | |

| Number of shares (in thousands) | 41,067 | 41,067 | 36,472 | - | 12.6% | |

| Market cap (R$ million) | 636.5 | 736.4 | 519.7 | -13.6% | 22.5% | |

| Quote¹ | ||||||

| BHGR3 (R$) | 15.50 | 20.19 | 14.25 | -23.2% | 8.8% | |

| Small Cap Index² | 1,200 | 1,439 | 1,173 | -16.6% | 2.3% | |

| Ibovespa | 56,754 | 69,305 | 68,588 | -18.1% | -17.3% | |

| Dow Jones | 12,218 | 11,578 | 10,428 | 5.5% | 17.2% | |

| Average monthly share volume | 463,200 | 809,250 | 1,369,167 | -42.8% | -66.2% | |

| Average monthly financial volume | 9,256,097 | 14,275,551 | 18,930,890 | -35.2% | -51.1% | |

* Amounts updated in accordance with the share split on January 12, 2010 (1:20).

¹ End of the quarter; ² Small Cap Index of BM&F Bovespa; Source: Bloomberg.

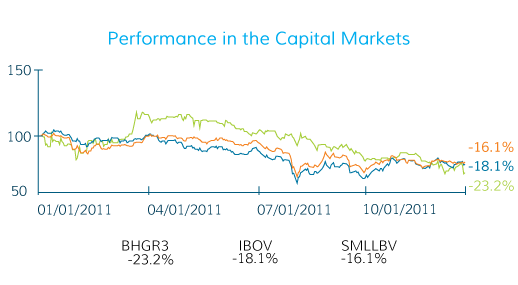

During 2011, the global economy was characterized by fiscal difficulties throughout some countries from the European Union (EU). The prolonged crisis and difficulty in approving a financial aid package for such countries, and the resulting insecurity created among economic agents, had a strong impact on capital markets worldwide, which presented a very meager performance in the period.

Despite growth of almost 3.0% in the Brazilian economy, the risk-adverse scenario thanks to difficulties in the EU cast a shadow over the performance of the Bovespa, which posted its third worst showing since 1994, falling by 18.1% in the year.

In the midst of such uncertainty, the Company's shares suffered, presenting a negative 23.2% change in relation to the end of 2010.

Performance subsequent to the fiscal year

In early 2012, the improved international scenario and the entry of fresh funds to Brazilian stock markets benefitted the macro scenario, thus contributing to a recovery in the price of the Company’s shares.

In addition, the entry of important investors and the lower sales pressure on the Company stock in the initial months of 2012 led it to decouple from the BM&FBovespa Index and appreciate sharply to reach R$22.60 on April 30, 2012, gaining 46.0% over the closing price of R$15.50 on December 31, 2011.

REMUNERATION OF THE SHAREHOLDERS

In accordance with the Company’s Articles of Incorporation and Bylaws, its minimum dividend for fiscal years stands at 25.0% on net income, equal to R$9.6 million in 2011. Nonetheless, the minimum dividend, which would have been R$2.4 million, was allocated to offsetting losses accumulated up to 2010, which totaled R$96.0 million. In allocating all net income to offsetting accumulated losses, the Company decreased these losses to R$86.3 million at the end of 2011.

The Board of Directors is responsible for defining and approving the distribution of dividends and/or interest on capital. The decision is based on the results presented in the annual - or half-annual - financial statements, and on factors, such as the Company's operating income, financial situation, need for funds, prospects, and other issues deemed relevant.