We enjoyed excellent operating performance in 2013, despite Brazil's slow economic growth, higher interest, inflation rates and weaker local currency. Our results further reaffirm the resilience of our business and especially our assets. Our history has shown that, despite moderate economic growth in recent quarters, we consistently record excellent operational and financial indicators.

We posted consistent growth in our total sales, reaching R$22.0 billion in the year, which represent growth rates of 12.1%. Same store sales (SSS) were in line with our expectations, with growth of 7.5% in the year, a slight increase from 2012.

We recorded NOI of R$1.2 billion in 2013, an increase of 16.6% from the year-ago period, with margin of 91.7%, which is our highest margin since 2009. Another line in which we posted strong growth was adjusted EBITDA, which surpassed R$1.0 billion in 2013, or 17x higher than at the end of 2006, in the early days of the company. We became the first and only Brazilian Mall company to surpass the mark of R$1.0 billion in EBITDA. Adjusted FFO was R$497.0 million in the year, increasing 18.2% from 2012, while adjusted net income came to R$487.0 million, up 18.9% from 2012.

Throughout the years we maintained our efforts to optimize common costs, enabling us to reduce the occupancy cost of tenants from 10.6% in 2012 to 10.4% in 2013. The low occupancy cost registered during the year contributed towards our malls to end the year with a vacancy rate of only 2.1%.

In 2013 we recorded a 24.3% Leasing Spread in our contract renewals, which reflects the strength of our assets and our revenue’s long term potential growth. Seeking to improve the experience of our consumers, our marketing department brought special moments to thousands of families through exclusive BRMALLS events, such as Disney, Galinha Pintadinha and Angry Birds. As a result of the high occupancy rate and enjoyable experience, our assets received over 470 million visitors during 2013.

We inaugurated 4 expansions in 2013. In the second quarter we inaugurated the expansion of Plaza Niterói located in Rio de Janeiro; in the third quarter the expansion of Natal Shopping, which is located in Rio Grande do Norte and i n the fourth quarter we launched 2 expansions: Shopping Rio Anil, located in São Luís, Maranhão and Shopping Sete Lagoas, located in Minas Gerais. We inaugurated a total of 68 thousand m² of total GLA and 39.9 thousand m² of owned GLA.

In the fourth quarter we inaugurated our ninth Greenfield: Shopping Contagem in Minas Gerais, adding 34.9 thousand m² to our total GLA and 17.8 thousand m² to our owned GLA.

We concluded the year of 2013 with a total of 1,688.6 thousand m² of total GLA and 974.8 m² of owned GLA.

We envision that 2014 will be a challenging year to the Brazilian economy. However, we will work hard to strengthen the company internally and become more and more efficient in our operation and investments. In the third quarter we will launch Shopping Vila Velha, which is the company's largest greenfield project ever, which will open with over 71.7 thousand m² of GLA. We will also open 3 important expansion projects in 2014.

We are the largest company in Brazil's shopping mall sector in terms of total gross leasable area, owned gross leasable area and number of malls. We are also the country's largest suppliers of mall management services, as well as leasing and merchandising services.

We ended 2013 with 52 malls in our portfolio, comprising 1,668.0 thousand m² of total GLA and 974.8 thousand m² of owned GLA, with more than 9,000 stores leased and tenant sales of R$22.0 billion. Our average share of our malls is 57.7% in terms of GLA. When it comes to malls, which we hold at least a 50% share, they represent 87.2% of our total NOI in the fourth quarter. Our average share in these malls is 75.5%.

Our portfolio is strategically diversified according to the income levels and geographic position. Our highest concentration of NOI comes from the middle-income group. Brazil's emerging middle class has grown rapidly in recent years and should continue to growth.

Services

BRMALLS ended 2013 providing leasing services to 45 malls in our portfolio and management services to 43, while 36 are serviced by the CSC (shared service center) out of our total of 52 malls.

The Brazilian mall market began in 1966, with the inauguration of the first mall in São Paulo. Five years later, was the inauguration of the Conjunto Nacional de Brasília, developed by ECISA and one of the first Brazilian malls to follow the concepts and patterns of the international mall industry. In the 1970’s, together with the Conjunto Nacional de Brasília, five new developments were initiated. However, it was in the 80’s that this market presented its biggest growth, with the number of malls going up very fast, until the early 90’s, when the pace slowed down due to the financial instability.

In the mid 90’s, there was a new wave of investments in the sector, due to the financial stability derived from the establishment of the real as the new currency in Brazil, which controlled the Brazilian inflation thus stimulating consumption, and the success of investments in the mall sector during the 80’s. This flow of new investments was also a result of the higher availability of funds of pension fund’s portfolios, which began to invest in shopping centers and contributed significantly to the development of new projects. The pension funds, considered very conservative, were attracted by the nature of the shopping mall business, as a cash flow generator, and by the high return achieved by prior investments in the sector.

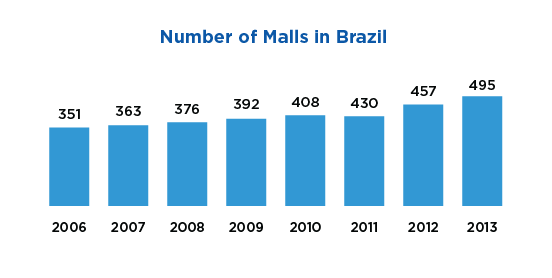

Given the high return rates of the sector, the number of malls grew very fast until the year 2000, when the sector reached a total of 281 malls. However, following 2001, there was a reduction in the number of mall openings. The main factors that explains this slowdown are the lack of available funds and funding methods and the reduction of interest of the pension funds in the mall sector, as a result of new regulations that imposed restrictions on real estate investments as a percentage of their total assets. This number increased in time and in 2013 the number of malls rose 72.2% (in comparison with the year 2000), reaching 495.

The current scenario of the Brazilian mall sector is best described as a sector going through its consolidation, since it is still very fragmented when compared to other countries. The top 3 (BRMALLS, Multiplan, Aliansce) players of Brazil hold a 20% market per share.

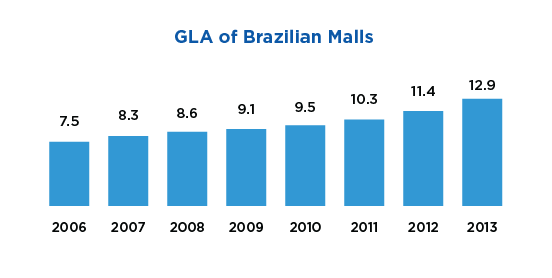

From 2006 to 2013 the shopping center sector grew 30.2%, representing 22.0% of the national retail and 2.7% of Brazil’s GIP. The total GLA of Brazil’s shopping mall sector grew 72.5% between 2006 and 2013, reaching a GLA of 12.9 million in 2013, as shown in the graph below:

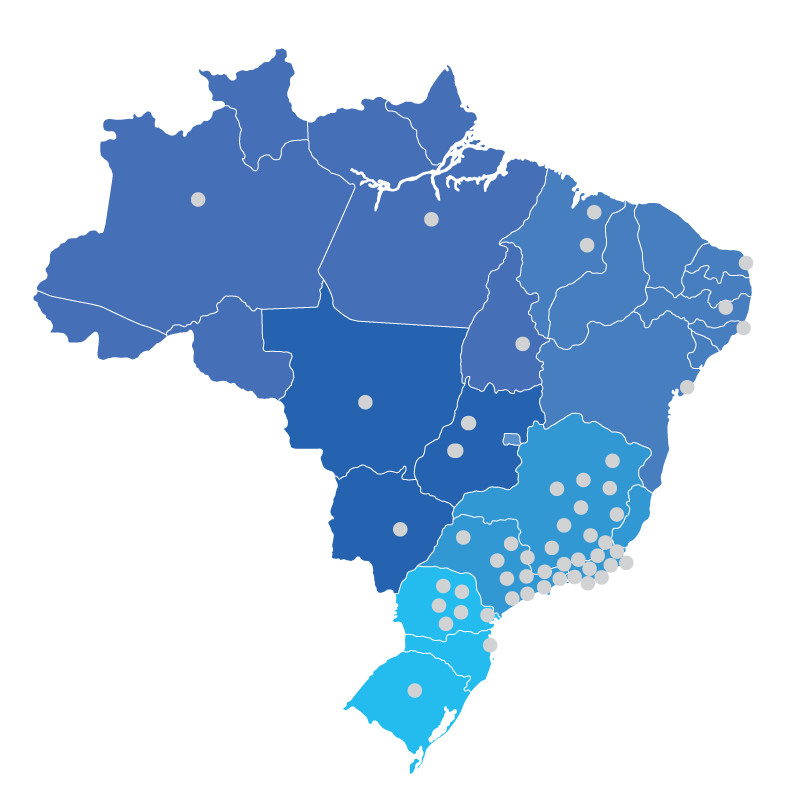

The total Gross leasable area for the sector, is divided geographically in the following manner: 58.5% in the Southeast region, region with the country’s biggest GDP; 16.6% in the South region; 16.0% in the Northeast region; 5.0% in the Middle - West region; and 3.8% in the North region.

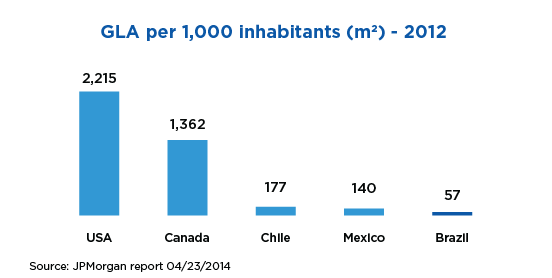

Even though the total gross leasable area grew enormously, when we compare the total GLA per inhabitant to other countries where the mall sector is more developed such as USA and Canada, it is still very low. This comparison shows that there is still a lot of space for new developments in Brazil.

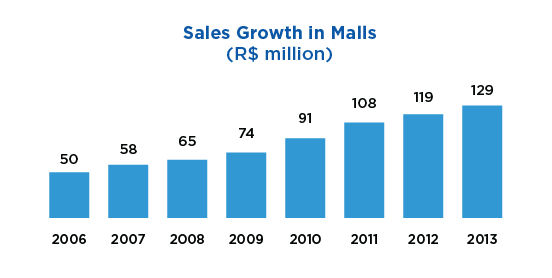

Together with the growth in the number of malls came the growth in its sales. The mall industry’s total sales grew 158.0% from 2006 to 2013, as shown below:

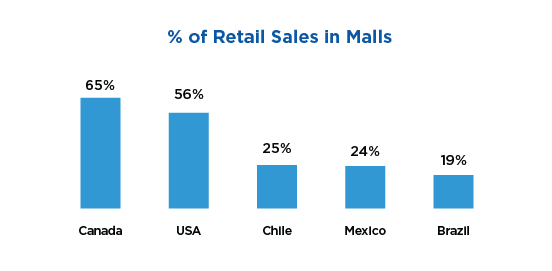

Brazilian shopping centers attract consumers not only for their stores, but also for the wide range of services in a single location, parking spaces and air conditioning. The sense of security and protection against tropical rains during the Christmas shopping season (the peak of retail sales in Brazil), are some of the reasons why growth in malls’ sales is bigger than the growth in retail sales in Brazil. As a result, the participation of malls’ sales in total retail sales is growing, and reached 22% in 2013, which is still low when compared to countries such as Canada and USA, in which malls’ sales represent more than 50% of total retail sales.

The growth in the mall sector also has an important role in the country’s economy, generating many jobs and helping the development of small communities through social works. In 2013, the sector offered 843 thousand jobs.

The mall industry is also very important in the development of small and medium cities. Although the majority of malls are located in big cities, in the last five years there has been a tendency to invest in malls in these smaller cities. The developments in these cities have a different format, they are smaller and their public is the population that lives nearby.

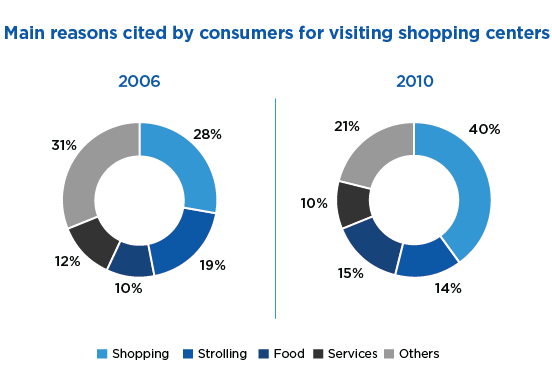

Another observed tendency is that of enhancing the malls’ social functions, offering a wide range of services as well as leisure and cultural activities. According to Alshop, in 2013 only 40% of consumers mentioned shopping as the main reason to visit malls, the rest of consumers are attracted by other services. The chart below shows the main reasons cited by consumers for visiting shopping centers:

For 2014, Abrasce expects an increase of 31 new malls in the country, indicating that, in 2013, we reached the peak of the development cycle of the last couple of years.

Our Dream

To be the biggest and the best shopping mall company of the world.

Our Values

Develop Owners

We hire, train and retain the best people and provide them with an environment in which they have responsibility, autonomy and feel like owners of the business.

Work with Simplicity and Agility

We have a simple, agile, flexible and transparent structure, and we respond quickly to opportunities and changes that occur in the market.

Perform with consistency and efficiency

We act with objectivity, sense of urgency, efficiency and humility, and consistently satisfy our clients and partners' expectations.

Prioritize Growth and Productivity

We are really focused in contributing to BRMALLS' growth, improving the company's productivity and profitability in the short and long term.

Focus on Results and Meritocracy

We work as a team and in a disciplined way in order to consistently exceed challenging goals, and allocate responsibilities and reward based on merit.

In 2013, net revenue was R$1,303.7 million, growing 16.0% from 2012.

We ended the year with NOI of R$1,207.2 million with a 91.7% margin, growing 16.6% from 2012.

We ended 2013 with adjusted EBITDA of R$1,055.4 million, growing 16.0% from 2012. EBITDA margin in 2013 was 81.0%.

In 2013, adjusted FFO was R$497.0 million, increasing by 18.2% from 2012.

The effects from the appraisal of our investment properties contributed with a revenue in the year of R$832.1 million.

Same-store rent grew by 9.8% in 2013, while same-store sales grew by 7.5% in the year.

We ended the year with an occupancy cost of 10.4%, of which 6.6% was related to rent costs and 3.8% to common and marketing costs.

We ended the year with an occupancy rate of 97.9% in our malls. Of the 52 malls in which we held ownership interests in the fourth quarter, 29 had occupancy rates higher than 99%.

We inaugurated the expansion of the Plaza Niterói Shopping in May with a total of 10.5 thousand m² of total and owned GLA, increasing the mall area in 31.3%. We estimate the project will generate R$22.2 million in stabilized NOI for BRMALLS.

Also in September the expansion of Natal Shopping was inaugurated adding 9.5 thousand m² of total GLA and 4.8 thousand m² of owned GLA to the mall. We estimate it will generate R$9.5 thousand in stabilized NOI for BRMALLS and a real and unleveraged IRR of 18%.

In October 2013, we launched the expansion of Rio Anil, which added 11.5 thousand m² in total GLA and 5.7 thousand m² in owned GLA to the mall, representing an increase of 43.6% and bringing the mall’s total GLA to 37.8 thousand m². We estimate the project will generate R$6.7 million in stabilized NOI for the company and a real and unleveraged IRR of 21.0%.

In November 2013, we announced the grand opening of Shopping Contagem, which is the company’s 9th greenfield project. With the opening, BRMALLS added another 34.9 thousand m² to total GLA and 17,8 thousand m² to owned GLA. We estimate the project will generate R$22.2 million in stabilized NOI for BRMALLS.

In December, we opened the expansion of Shopping Sete Lagoas, which added 1,5 thousand m² in total GLA and 1,1 thousand m² in owned GLA to the portfolio of BRMALLS. With this expansion, we expect to generate R$515.0 thousand in Stabilized NOI. The project was opened with a real and unleveraged IRR of 15.0%. The project increased the GLA of Shopping Sete Lagoas by 9.3%.

We believe that by implementing our main strategies, we will improve our operational development, maximize returns for our shareholders and generate competitive advantages, thereby fueling our growth. Our main strategies are:

Constantly seeking attractive growth opportunities through development and expanding our portfolio:

As mentioned before, we believe there is still considerable room to consolidate the sector through new malls (greenfields) and expansions.

In line with our consolidation strategy, we inaugurated our ninth greenfield, Shopping Contagem and 4 more expansions: Plaza Niterói, Natal Shopping, Sete Lagoas and Rio Anil, that together absorbed investments of R$189.4 million of investment and represent a stabilized annual net operating income (NOI) of R$64.9 million for our company.

Continually extracting value from the malls in our portfolio:

In addition to the sales growth and consumption boom that Brazil has been experiencing in recent years, we have always sought to extract the maximum amount of value from the malls in our portfolio. With an increasingly qualified team and an expanding portfolio, we have been able to achieve economies of scale and optimize low performing areas with projects seeking higher profitability.

Focusing on improving efficiency:

The best type of growth is accompanied by higher efficiency. We are always seeking means of improving our processes, by implementing the highest standards of operational, financial and personnel-related excellence, through the creation of a Shared Service Center (CSC), responsible for all administrative, financial, accounting, IT and other services for our offices and malls, and through the adoption of an integrated management system (Oracle Business). Thanks to improved processes, scale gains and increased bargaining power through the centralization of purchases and the outsourcing of cleaning, security and other services, we have been able to increase the focus on our core activities.

Our employees are our most important asset and we believe that we have the best team in the Brazilian industry. Our position as the country’s shopping mall leader, together with our accelerated growth plan, requires the continuous pursuit of talented professionals.

Investing in people:

BRMALLS has around 1,059 employees, 700 of whom work in the malls.

Our people management team spends considerable time and effort on developing and recruiting professionals, externally, internally and through our referral program. We also have two strategic programs for attracting new talents:

Trainee and internship programBRMALLS’ trainee and internship programs were created to attract and train talented young people to become future leaders and hold strategic positions within the Company. Nine trainees from previous programs are now managers and another eight are company partners, one is superintendent and 11 are coordinators. The 2013 program received 6,000 applicants, 12 of whom were selected.

Performance-based compensation

BRMALLS’ corporate culture is based on merit and focused on results. Our employees are tested against specific targets, as well as through a 360º evaluation. Compensation is based on objective goals (80%). We establish a set of targets for each employee and our bonus program is tied to the achievement of individual and collective goals. In order to monitor performance, we implemented a performance management tool that measures the progress towards the established targets on a monthly basis and we hold monthly performance meetings to monitor this progress. The others 20% of the compensation is based on subjective goals “the 360º Performance Evaluation System”, which is a mechanism for evaluating individual performance based on feedback from peers, as well as junior and senior management. The evaluation aligns the Company’s culture and values with those of our employees and serves as a motivational tool by letting employees know how they are regarded by the Company and what is expected of them.

Stock Option Plan

We grant stock options to the Company’s key employees. Our stock option plan seeks to retain these employees and align their interests with those of our shareholders, reinforcing the sense of ownership in our top managers. Currently there are 28 partners, including the first trainees.

PDN: The Business Development Program aims to align and expand the “Shopping Mall” business in BRMALLS’ vision, with lectures from the industry of malls and of areas in the company. It occurs every semester and lasts for two days.

PES: The Excellence Program in Shopping center aims to standardize excellent processes, increase revenue, reduce costs and mitigate risks. The program consists of 12 phases, which are the malls daily processes. Each phase is worth 1.000 points and there are 3 overall assessments measuring the execution of the processes, self-evaluation, final and partial rankings. After measuring the indicators, the external auditing tests the validity of the processes and add up the points. There are two types of awards, non-monetary, which are trophies and a monetary one.

PED: The Excellence Program in Development (greenfields and expansions) has the aim of identifying and disseminating best practices in order to achieve better results. It occurs annual and its divided in 12 phases. In this program the competition is not by malls, but by teams of 8 people, representing a project. The results come from two self-assessments and an external auditing, contributing for their company goals and trophy awards.

In 2006, when BRMALLS was established, we were the fifth largest mall company in Brazil; only three years later, we became the largest company in the sector. We achieved this position through a combination of hard work, excellence and teamwork, together with certain other differentials, such as our scale and performance-driven professional management, uniting all the competitive strengths that have helped ensure our continued sector leadership.

Strategically diversified portfolio

Our mall portfolio is strategically diversified both in terms of geographical location and income segment. We believe our nationwide presence and experience of running malls that target different income groups allows us to benefit from the economic growth of each region and group, minimizing the impact of fluctuations in regional economies and sectors while providing us with a key competitive advantage for the implementation of our growth and consolidation strategy.

Professional management and the best operating performance

We have an exemplary team of professionals who are widely recognized in the market and have substantial experience in shopping mall, real estate and financial sectors, as well as general management. Our compensation policy seeks to align the interests of these professionals with those of our shareholders through a bonus program and stock option plan that reward good performance and the achievement of established goals. However, being the best mall operator in the sector requires more than just a strong team, so we have also implemented several management tools to ensure the best possible operating performance. We focus on improving our results while maintaining the quality of our operations through practices such as tenant mix planning, quality indices, standards of excellence and meticulous control over late payments.

Multiple growth opportunities

The Brazilian shopping mall industry presents us with unique growth opportunities. The combination of retail sales growth and the fragmentation of the mall market create excellent opportunities for the development of greenfield projects and the acquisition of interests in existing malls. Our growth strategy has several competitive advantages, including the successful track record of our management team and our principal shareholders, as well as privileged access to opportunities arising from the latter's extensive network of relationships. Our diversified growth strategy, through new projects and acquisitions, is another key advantage, allowing us to benefit from the multiple opportunities in the Brazilian market.

Most efficient company in the sector

Since 2006 we have implemented a series of measures to increase our margins, focusing on cutting costs, increasing revenues, improving collection tools and reducing vacancy. As a result, we have the highest margins of any listed company in the Brazilian shopping mall industry and they are expected to widen still further following inauguration of the new malls and expansion projects envisaged in our business plan.

Size matters

Our nationwide presence and position as the leading shopping mall company in the sector has increased our bargaining power with outsourced companies and retailers, and diluted our general expenses and investments in technology thanks to our more extensive asset base. Our size also allows us to attract and hire the best people and offer more opportunities to our employees. Also, scale give us advantage in a more competitive scenario, in which we don’t see it as a threat, but as an opportunity to consolidate the sector.

Turnaround

The turnaround process consists of three stages. The first one is the takeover, which offers rapid gains. Its objective is to implement our culture and controls, hire the base team and reduce vacancy. This phase lasts for 12 months. The second stage is consolidation, which takes from 12 to 30 months and is achieved through indicator-based management, the application of all of the management tools, strong team skills, MANOI and participation in the Mall Excellence Program. The final stage is that of the mature shopping malls. It consists of innovating and exporting talent, obtained by piloting new tools, cultivating a stabilized team and obtaining the latest information related to the three stages. This phase lasts from 30 months on. The principals involved in each of these three phases are: people, processes and discipline.

Throughout 2013, the Company focused on improving its corporate governance practices. Our IR team worked hard on keeping investors and analysts even better informed of important developments within the Company by holding events, increasing coverage and optimizing meetings and conferences.

BRMALLS Day

In the final quarter of 2013, we held an event, which took place on December 11th at São Paulo, uniting several analysts and investors for a morning presentation by our Company. All of the Company’s executive officers took part, including our CEO, Carlos Medeiros. Participants also had an opportunity to take a guided tour of Shopping Villa Lobos and ask questions about the mall. Due to the success of the event, we hope to do something similar in 2014 at another Company property as part of our efforts to keep the market informed about BRMALLS.

Conferences

Conferences are extremely important opportunities for meeting with investors and analysts, as well as expanding the Company’s international visibility. Given that BRMALLS has many foreign investors, participating in international conferences is one of our primary IR goals. In 2013, the Company took part in 15 domestic and international conferences.

Meetings

It is also crucial to maintain contact with shareholders and potential investors on a daily basis. Our IR team organizes non-deal road shows and conference calls, as well as meetings with investors, analysts and anyone else who wants to find out more about the Company. This allows us to keep our investors and analysts abreast of what is happening at the Company and what to expect in the future.

Analysts

One of the simplest ways of expanding our investor base is through coverage by analysts from important banks and other financial institutions. We currently have 15 analysts tracking the Company.

BRMALLS has been listed in the BOVESPA's Novo Mercado trading segment since 2007, under the ticker BRML3. It is also present in the U.S. market through a Level 1 ADR program on the OTC market under the ticker BRMLL. Below are some key share performance figures in 2013:

Share performance (12/31/2013)

R$17.05 (-5.9%) and Ibovespa (-15.5%) in 2013.

Market cap:

R$7.8 billion;

R$21.44;

11,180 shares;

R$87,2 million (2013)

Index

The Company’s shares are currently included in 31 indices, including some of the BOVESPA’s most important:

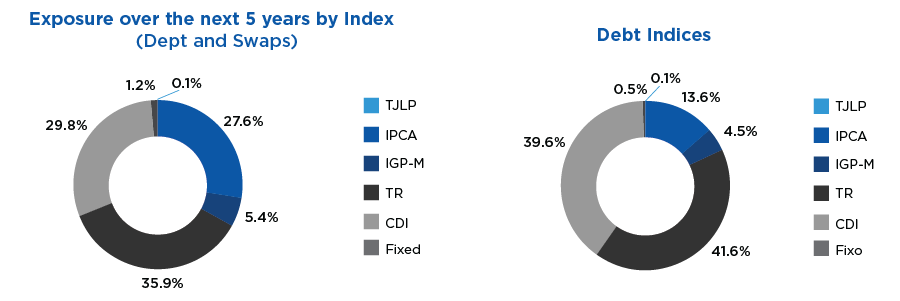

Debt Structure

BRMALLS’ executive officers are its legal representatives and are primarily responsible for the day-to-day management of its business and for implementing the general policies and guidelines determined by the Company’s bylaws and by its shareholders and board of directors. BRMALLS' board of directors is its decision-making body responsible for formulating the general guidelines and policies for its business, including its long-term strategies. Among other matters, it is responsible for appointing and supervising its executive officers. Our board of directors and board of executive officers at the end of 2013 are listed below:

Caring for future generations

Since its inception, BRMALLS has been introducing the best operational and financial practices into its malls, over the years BRMALLS implemented several projects that will help the environment and allow the company to grow in a more sustainable manner. Whether through educating its customers or by adopting internal measures, BRMALLS is having an increasingly beneficial impact on its surrounding environment. Below are some the practices that we have adopted at our malls:

Recycling

We are fully aware of the impact of urban waste on our planet and the crucial importance of recycling, which is mandatory at our malls. The waste generated by all the malls we manage is separated according to type into clearly-labeled individual containers located in corridors and food courts, and we try to recycle as much as possible. We also ensure appropriate treatment for special types of waste, such as batteries, florescent lamps and oil. This practice is included in the quality control process carried out by Bureau Veritas and is a priority at every mall managed by the Company

Energy Savings

We focused our efforts on identifying new means of saving energy. Among these projects was the retrofit of the Water Cooling Center, which involved replacing old air conditioning machines with more efficient models that consume less energy and, as a result, help to preserve the environment. Del Rey, Campinas, Fashion Mall, Ilha Plaza, West Shopping and Plaza Niterói are malls that already received the retrofit. In addition, we purchased energy on the open market from small hydroelectric plants (SHPs) and small thermoelectric plants (STPs), both of which are beneficial to the environment and economically sustainable. We also carried out studies into the possibility of replacing current light bulbs with LED lights, which are approximately 30% more economical.

Water reuse and awareness

At BRMALLS, we are aware of the importance of water to our planet and we have therefore adopted a series of measures to reduce water consumption. We seek to raise awareness of the issue among our mall customers and employees through signs and stickers in bathrooms, as well as specific training programs. We also treat and reuse the water we consume at several of our malls. At Norte Shopping, for example, rainwater is reused in the courtyard fountain and wastewater from the cooling and air conditioning systems is reused. The mall also held a month-long exhibition in partnership with Greenpeace aimed at raising awareness among consumers and reducing environmental impact.

Social responsibility

BRMALLS is the largest shopping mall company in Brazil, reaching a huge number of consumers. As such, we are well aware of our ability to influence our surrounding communities. Every year, we make the common areas of our malls available for vaccination, disease prevention and NGO fundraising campaigns, organize workshops for children and the elderly, and distribute donations to orphanages and NGOs during the Christmas season.

The Empty Store Project

In December 2013 we announced a clothing donation project in Shopping Villa-Lobos. It was a glass pop up store with empty shelves, mannequins and showcases. Throughout the day the store would slowly fill up with donations of clothing items from the mall customers. The store was emptied out every morning and was again filled up with donations during the day. This initiative was internationally recognized, being awarded the Golden Lion at the Cannes Film Festival. We are studying a corporate sponsorship to be able to replicate this action to our portfolio.

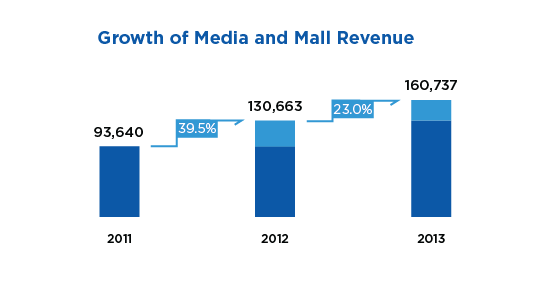

The Mall & Media revenue line has grown consistently in the last years. This reflects our strategy of complementing the retail channels through temporary spaces (mall) and through advertisements (media). The main factors driving this growth were:

-Scale and national coverage, enabling greater access to retailers and national advertisers;

-New formats and media properties.

-Increased effectiveness of the sales team dedicated to mall & media, providing broad local service and also national service (key account) for the major advertisers.

These factors enabled a great revenue growth: In 1Q14 Mall & Media represented 14.7% of our Gross Revenue and increased 18.1% when we compare to 4Q12 results.

Media

The Company has restructured customer service media, consolidating it into a specific department and designating a Director of Media. The main customers have exclusive service treatment in order to invest in multiple malls in our portfolio. We now have a dedicated Media sales force. We broke bureaucratic barriers in order to speed the media announcement process. The simplification of the process and exclusive service treatment were fundamental to increase the amount of customers who hire media at BRMALLS and the investment volume of our largest current clients.

SulAmérica Partnership

The partnership with SulAmérica Seguros is the largest media project ever made by the company. The project consists of marketing actions in our malls, set-up of automotive centers that offer support services to insured vehicles and a wide dissemination of the benefits through media in our malls. The campaign includes 34 of our malls, in all regions of the country, such as: Norte Shopping, Villa-Lobos, Tamboré, Center Shopping Uberlândia, Shopping Estação, Amazonas and Paralela.

In addition to the media revenue, the services in the automotive centers provided to SulAmérica Seguros clients will contribute towards attracting more traffic to the malls.

This new project, not yet seen in Brazil, launched by BRMALLS and SulAmérica Seguros, demonstrates the company’s capacity to attract new advertisers and leaders in various segments.

Partnership with Itaú Unibanco

At the end of 2013 we partnered with Banco Itaú, so that customers in all regions of the country could participate in the Hyper Christmas 2013 and Itaucard and thus compete for the prize that each mall had picked. For every R$ 200.00 to R$ 250.00 spent by the customers they would get a coupon. Customers, who purchased with Itaucard cards could double their coupons. The more coupons a customer accumulated, the better the chances of winning the prize. Itaú also offered incentives for the tenants that were clients of the bank.

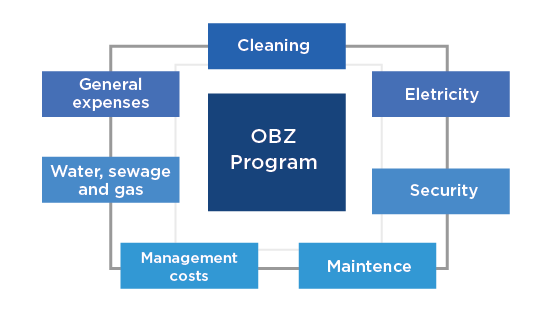

Reducing common costs - OBZ Program

The OBZ Program is a management program to improve condominium costs and therefore contributing to the Company’s’ sustainable growth. It aims to eliminate the inefficiency in costs from previous years and stimulate a culture of efficiency.

The implementation of the OBZ methodology program introduces management tools previously unexplored, which act as reductions mechanisms of condominium costs. 200 commandments were turned into cost reduction actions in malls. The program grouped the costs in seven “packages” according to the nature of the costs.

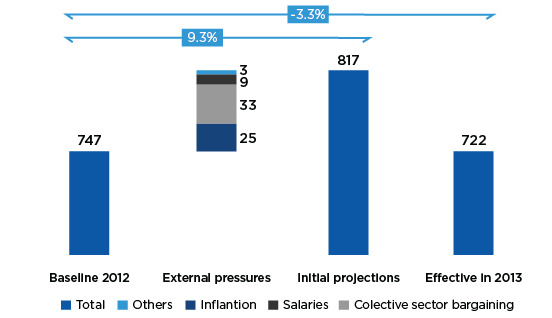

Each package has an owner that is responsible for the results. If we did not consider our improvements in 2013, the condominium would grow 9.3%, or R$ 70MM compared to 2012. We closed the year down 3.3% from the previous year.

One of the major motivations for the implementation of the OBZ program was not only the control of our condominium expenses, but also the occupation cost, allowing for the sustainable growth of our revenues